Premier League clubs clear tax arrears as football governance report looms

By Steve Menary

16 June 2011

The Premier League’s clubs have cleared their entire backlog of tax debts to Her Majesty’s Revenue & Customs (HMRC), a well-timed development ahead of a government report into the governance of football that could pose difficult questions over the financial affairs of clubs in the world’s richest club competition.

At the end of the last tax year, as this website previously reported, the Premier League collectively owed £14.4m in PAYE, National Insurance contributions and VAT. That figure rose to £27.4m a few months later as the full scale of Portsmouth’s tax liabilities were uncovered by HMRC.

Two of the key questions that the Select Committee's investigation into football have sought to address are:

‘Are football governance rules in England and Wales, and the governing bodies which set and apply them, fit for purpose?’; and

‘Is there too much debt in the professional game?’

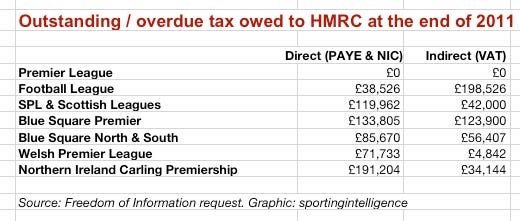

A Freedom of Information enquiry by sportingintelligence shows the Premier League is the only one of the UK’s 14 senior leagues to have no tax outstanding at the end of the 2011 tax year.

The Premier League's head of communications, Dan Johnson said: “The previous issue was entirely related to Portsmouth. The financial and governance regulations our clubs now operate under mean [that] it is very hard for them to get into arrears.

“Our clubs are run on very sound accountancy practices that make it very difficult to. When combined with our HMRC reporting provision and the welcome new stance of HMRC in ceasing to indulge football, mainly smaller Football League clubs, we think that it is an issue that is sufficiently mitigated.”

Sources close to HMRC insist that Portsmouth was not the only tax-indebted club and that a number of smaller Premier League clubs apart from Pompey also had outstanding tax liabilities last year.

HMRC also points out that the debts are a snapshot taken on a single day and expects that football’s current tax debts of £900,000 to rise over the course of the year. The latest FOI figure does not include debts liabilities of clubs that cannot pay the full sum up front and have agreed a payment plan spread over a period of time.

In a note with the FOI, HMRC said: “Extreme care should be taken not to attribute the level of debt shown in the accompanying figures to a resolution of the bulk of football debts owed to HMRC.”

HMRC’s continued crack-down on tax avoidance among the UK’s football clubs has seen special units set up in Solihull and Worthing.

Last year, 40 winding up petitions were sought against the companies that own clubs in the Premier League, the Football League, the three divisions of the Conference and the Welsh Premier League and sportingintelligence identified 19 clubs in the top seven tiers of the English football pyramid that were subject to winding up orders during 2010.

So far this year, HMRC has succeeded in winding up non-league side Windsor & Eton and sought winding up petitions against Plymouth Argyle and two former Football League sides Rushden & Diamonds and Kidderminster Harriers.

That purge against tax debts has reaped rewards with the total monies owed to HMRC by the clubs in Championship, League One and League Two down to £236,782 at the end of the latest tax year. That compares with a liability of £7.4m according to an earlier FOI request by sportingintelligence.

The reduction at the Football League comes after the competition agreed in 2009 to allow HMRC to directly monitor the PAYE of its clubs and impose transfer embargoes on sides that fail to meet their tax debts promptly. At the end of the last tax year, the Championship clubs alone owed £5.3m in indirect tax, i.e. PAYE and National Insurance contributions.

"Whilst this is only a snapshot of a particular date, and the amount owed will undoubtedly fluctuate significantly during the year, payment performance in respect of PAYE and VAT in the Football League is significantly better now than in previous years,” said the HMRC.

"We have worked closely with the Football League over the past 18 months which has contributed to that improved performance but we have where appropriate taken firm and effective action to ensure Club’s pay their liabilities on time."

The Premier League subsequently adopted the system pioneered by the Football League, while the Blue Square Conference also monitors tax liabilities but these have still risen according to the latest HMRC figures.

At the three Blue Square divisions, indirect and direct tax debts totalled £399,782 at the end of the last tax year – up from £344,955 a year ago. Those debts are understood to relate to two clubs, one unnamed clun that that the Conference insists has subsequently settled with HMRC and another - Rushden & Diamonds - that has since been expelled from the competition.

Conference director Colin Peake said: "It is impossible to assess at anyone time what the figure is for monies owed to HMRC for a variety of factors. We have the largest turnover of member clubs each season, 8 in and 8 out. Sometimes we therefore inherit figures, which we have no control over until they become members.

"We are proactive in the terms of quarterly financial reporting, with clubs being deducted points for misleading submissions etc. This is being made harder, as all member clubs have now agreed this year that their personal details held by HMRC are shared with the Conference. This means we have the ability to check information is accurate and take action where it is not. The figure may also be somewhat inflated by the payment methods which HMRC has with clubs on a personal and local office basis. "Our club affairs are improving all the time. Two clubs may also be the main contributors to the figures you have been supplied but we cannot comment with certainty on that. However if that is the case, then one has settled and the other has been expelled from our competition."

There was also a rise in liabilities at the Welsh Premier League, where the licensing criteria put in place by the League of Wales (LoW) are supposed to prevent any clubs piling up tax debts. The LoW tax burden has leaped by two thirds over the last year with £71,733 in direct tax due and £4.482 in indirect tax.

That compares to a £42,583 direct tax debt at the end of the 2010 tax year and the Football Association of Wales declined to comment on the rise but on June 9, HMRC sought a winding up petition against the parent company Neath FC. The debt would preclude Neath from playing in the LoW next season. Neath, which has qualified to play in the 2011/12 UEFA Europa League, dispute the liability but did not respond to a request for an explanation from sportingintelligence.

In Scotland, Falkirk was also subjected to a disputed winding up petition from HMRC in February this year but that order was quickly rescinded as the club had already agreed to staged payments. Total tax debts at the four main leagues in Scotland are just £161,962 but the dozen clubs in Northern Ireland’s Carling Premiership owe nearly as much in tax as the entire English Football League.

The Irish dozen owed a total of £191,204 in PAYE and National Insurance at the end of the last financial year plus another £34,144 in VAT. HMRC sought to wind up Distillery early last year and in Autumn 2010 tax liabilities at Glentoran were reportedly nearly £300,000. A rescue package for Glentoran was subsequently agreed and a winding up petition dismissed but the club was back before Belfast’s bankruptcy court last month after a petition brought by sportswear maker Umbro. This petition was also dismissed. Glentoran did not respond to a request for a comment from sportingintelligence.

The Irish Football Association would not comment on individual clubs but the IFA's domestic marketing manager, Graeme Beggs, said: "The Irish FA is aware of the financial difficulties in the current economic climate and have introduced a new Salary Cost Protocol for the 2011-12 season to help clubs control and manage their finances more efficiently. Each club has been given a percentage of their allowable income that they are allowed to spend on players and salaries etcetera - 45 per cent to 60 per cent, depending on their situation with HMRC."

HMRC’s purge against football’s tax debts will move forward another stage on 28 November. That is the date that a long-running and much delayed challenge over the Football Creditor’s Rule, which allows football-related bodies and people to be paid before other creditors if a club fails, finally comes to the High Court.

.

Links to some of the lowlights from the Portsmouth saga last year