Manchester clubs lead way as PL shirt deals climb to £315.6m

By Alex Miller

30 July 2018 This article was updated on 14 August with a new graphic

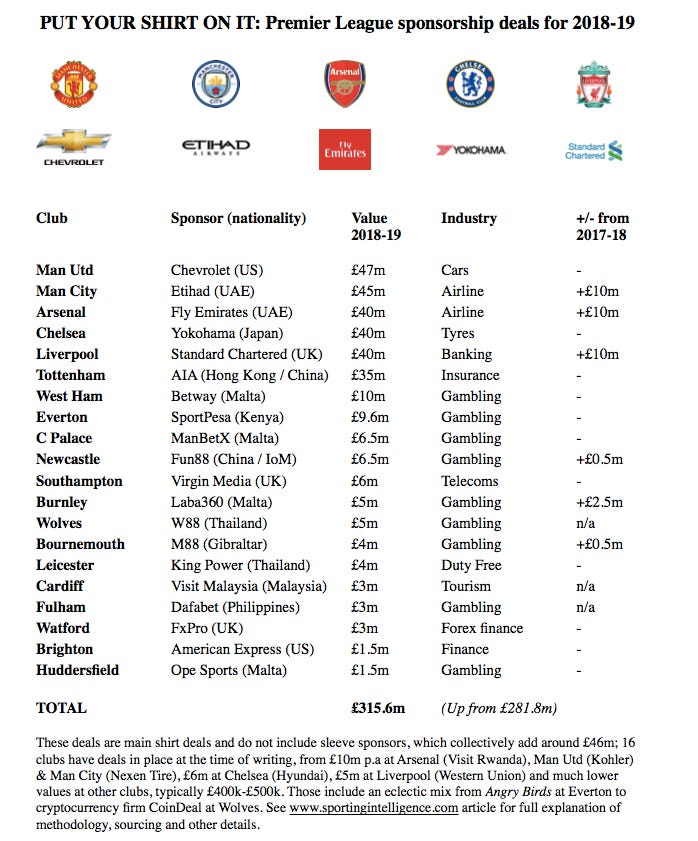

Premier League clubs have broken their own record for combined shirt sponsorship deals, with the 20 clubs generating £315.6 million for the 2018-19 season, a rise of £33.8m on last year. This is 'only' for the main sponsors on the fronts of the shirts. Sleeve sponsors are paying a further £46m to the 20 clubs combined.

The increase again illustrates the commercial strength of the League with shirt sponsorships more than trebling in eight years. The combined total in 2010-11, when Sportingintelligence first performed this exercise, was £100.45m.

Manchester United’s club-record deal worth £47m a year with Chevrolet remains the biggest deal in the Premier League but Manchester City’s deal with Etihad has climbed to £45m per year via another ‘step increase’ in their contract, meaning they now have the second biggest deal.

Liverpool’s renegotiated deal with Standard Chartered has grown to £40m-a-year, while Arsenal’s deal with Fly Emirates has leapt £10m, also to £40m per year. Chelsea’s deal with Yokohama (tyres) is also worth £40m a year.

Spurs are set to move into the new White Hart Lane stadium in London soon – with attractive football and consistent top three finishes in the league, the club continues to prove attractive to sponsors. The club’s deal with AIA is worth £35m a year, completing the big six’s deals, which are head and shoulders above the Premier League’s remaining 14 teams, in terms of value.

West Ham’s deal with Betway is the seventh largest in the league worth £10m a year - £25m a year less than Spurs’ deal.

Article continues below

2nd August update note: Burnley's deal was actually increased to £5m-a-year following qualification for the Europa League; this was not initially communicated when this table was compiled but we have been updated now and are happy to confirm this.

.

The international appeal of the Premier League is once again demonstrated with 17 clubs having sponsors with overseas headquarters based in countries as diverse as the USA, China, Japan, Thailand, the United Arab Emirates, Malta, Kenya and The Philippines. Only Liverpool, Southampton and Watford boast British-based sponsors.

Despite a blanket ban on gambling within football, nine Premier League teams will carry sponsorship from gambling companies this coming season. As we noted last year, it is tempting to conclude that if you are a ‘big’ enough club with enough clout to attract a major international corporation or business, then your owners would rather stay away from ‘tawdry’ sponsorship deals with gambling firms.

All clubs, by definition, see themselves as rooted in their communities, and are therefore 'community' clubs and 'family' clubs. Why would any club in the truest sense want to be pushing gambling companies at children? If you can’t get big bucks from a non-betting multinational, then gambling firms are evidently the genre willing to inject millions to boost their market share.

All the figures in the table have been sourced from one or both sides of the deals concerned, and all have been run past the clubs for pre-publication checks. Some of these numbers are available via formal regulatory filings - as is the case with Manchester United's deal, which was negotiated at a flat rate per year pegged to the exchange rate at the time of the deal, hence the consistency of the £47m per year despite currency fluctuations. This is actually a minimum figure guaranteed by currency hedge 'insurance' taken at the time of the original deal. With big swings in the £-$ since, the actual amount in pounds has risen well above £50m in some years. This is offset to some extent by the currency hedging charges but illustrates the fluidity in value even in 'set' deals - not to mention their complexity at times.

There is sometimes a case that a club might overplay how much they are earning to make themselves look smarter (or include potential bonuses rather than realised sums), and for sponsors to underplay what they are paying for the same reason. Hence our checks on both sides of the deals and with independent third parties in the industry, including brokers, with knowledge of the deals. The figures in the table are those that we, and those parties, can vouch for.

Not included in the figures in the table above are new deals for sleeve sponsorship, which began for the first time in 2017-18. Manchester City, Arsenal and Manchester United all have deals valued at £10m, while Chelsea’s deal with Hyundai is worth £6m and Liverpool’s deal with Western Union is worth £5m a year, sources say.

The remainder of the league are typically negotiating deals worth hundreds of thousands per season, not millions.

This is the ninth year Sportingintelligence has produced this research. The season-by-season and club-by-club deals for previous years can be seen here:

2010-11 sponsorships 2011-12 sponsorships 2012-13 sponsorships 2013-14 sponsorships 2014-15 sponsorships 2015-16 sponsorships 2016-17 sponsorships 2017-18 sponsorships .

Relative impact of shirt deals against TV revenue

Shirt deals are one revenue stream among many that feed the coffers of Premier League clubs. All clubs earn money from three key streams: match day income (tickets, food & drink, hospitality, programmes, hoardings and so on), media income (mainly TV rights) and commercial income (including sponsors, where shirt income is often but not always the biggest component). In the graphic below we look at the relative importance of shirt deals over the past six years as TV income has continued to grow at an enormous rate. This shows 1) total shirt deal income for the 20 clubs each season since 2010-11; 2) the biggest shirt deal each year, and value; 3) the average deal value; 4) the average amount of money each club has made from Premier League central funds from TV; 5) a comparison between shirt income and TV income measure by the relationship between the two. (For season-by-season details of what clubs make from television CLICK here; follow links for earlier seasons). Give or take a couple of percentage points, there is a consistent pattern that an ‘average’ club makes just more than one tenth of the amount each season from their shirt deal as they do from Premier League TV income. Or to flesh out the example, in 2010-11, the average shirt deal was worth £5m a year and the average TV income was £47.6m. Last season, the respective figures were £14.1m and £121m, so the ratio was 11.6%. .

. Follow Alex on Twitter @AlexMiller73 More on Chelsea / Man Utd / Arsenal (or search for anything else in box at top right) More from Alex Miller Follow SPORTINGINTELLIGENCE on Twitter