Anti-Glazer figures show Manchester United owners’ net assets are worth £1.1bn

By Nick Harris

7 June 2010

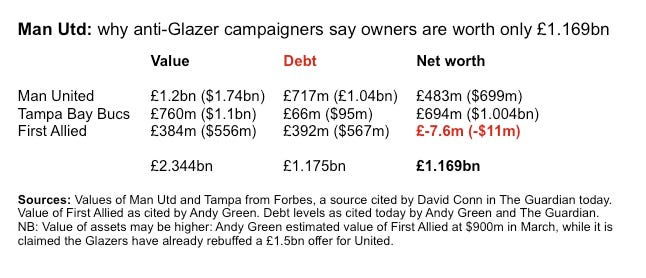

The Glazer family, owners of Manchester United, have net assets of slightly more than £1.1bn according to calculations based on figures cited today by anti-Glazer campaigners who have unearthed details of the family's property-related debts in America.

The Glazers now own only three major businesses: Manchester United in the Premier League, the Tampa Bay Buccaneers in the NFL in America, and the First Allied Corporation, also in the USA, which owns and manages property, mainly 64 shopping centres.

It has been a matter of public record for years that the Glazer family “leveraged” their 2005 takeover of United with borrowed money, and placed large amounts of debt onto the previously debt-free club. They also borrowed money in 1995 to buy the ‘Bucs’.

Now a new piece of research by an anti-Glazer campaigner, Andy Green, has shown First Allied has been badly hit by the recession and by the mortgaging strategy of the Glazers.

Green is a 37-year-old City fund manager, who is a United season ticket holder and advisor to the Manchester United Supporters Trust, and has published the research on his Andersred blog.

Green’s research, which forms the basis of two articles in today’s Guardian here and here, as well as a Panorama special to be screened this week, shows the Glazers have £392m ($567m) of outstanding mortgages on properties nominally now worth £384m ($556m).

In March, Green estimated the property portfolio could be worth $900m (in a blog that needs to be read for context) but that has now been downscaled.

Green explained in an email to sportingintelligence today: “My previous guess was way off. I was using a flat net rental income per square foot of $12m and capitalising that at 7.5%. Now I know the costs properly I can see the cash flow per square is actually $10/ sq ft (income is $16) and looking at similar properties has made me increase the cap rate to 8.5%. It's me who's changed, not the centres.”

Using information and sources cited by Green and / or The Guardian, the Glazers apparently have around £2.344bn in assets (see table below for details) and £1.175bn in debts, and therefore net assets of £1.169bn.

It appears the debt alone is dominating the headlines today, with mentions of the net assets few and far between, but that is naturally to be expected in an adversarial system where the Glazers are the obvious “baddies”.

The Glazer takeover has provoked long-standing protest from MUST and other groups, and also prompted the Red Knights group of super-rich fans to explore options for leading a fan-based buyout, a plan that has been mothballed for the time being.

The main bone of contention over the Glazers has been their leveraging, and the use of club profits to repay interest on debt. This differentiates them from Roman Abramovich at Chelsea and Sheikh Mansour at Manchester City, for example, who have effectively used the assets of Russia and Dubai to fund their clubs.

Andy Green’s blog is recommended: he has amassed a wealth of material and meticulously sourced hundreds of documents that allow fans and other readers to assess the economic impact of the Glazer takeover.

Last month, commissioned by MUST, Green also performed an analysis of how much the Glazers have cost United in fees and interest since their takeover. The findings were posted on 18 May (scroll down at this link).

However, the headline figure of £437m (which becomes £460m in the Guardian today) is arguably disingenuous because it contains some money not actually spent, yet, and neither does it factor in money saved under the Glazer regime, including in dividend payments and corporation tax.

The figure of £437m (also quoted in places as “almost £450m”) has been used by fans’ groups, especially MUST, to argue the Glazers have spent that sum during a period that total ticket receipts were £398m. To repeat an oft-made (but not actually true) claim: “In the last five years, supporters could’ve attended every game at Old Trafford for free and been given a lump sum of £800 cash each and the club would still be in the same financial position.”

The problem with such claims is that when they’re tested - and they fail to stand up - they undermine the credibility of anti-Glazer groups, and can confuse fans who have real concerns about a culture of club ownership rooted in debt.

Andy Green argues it is entirely valid to include £83m of not-yet-paid interest on the most damaging PIK debts as part of his £437m, because it will have to be paid at one time or another.

Equally, Green acknowledges to sportingintelligence that his £437m could be amended to £236m, by adding £5m previously underestimated in his calculations (to £442m), then deducting not-yet-paid PIK interest of £83m, saved tax of £85m, and saved dividends of £38m, to provide an actual figure “wasted” by the Glazers so far of £236m.

This is still a lot of money, evidently, but it is not £450m.

An important part of the battle for long-term control of United is the PR battle, and while both sides make claim and counter-claim, reality risks being distorted, and a casualty of that can be supporter expectation.

For example, many fans who have backed the Knights and MUST are likely to be puzzled and disappointed now that no bid has arrived yet. In fact, it was always likely to take many months, if not years, to get to a realistic bidding position.

Similarly, today’s headlines about the Glazers having more than a billion in debt, while true in terms of gross debt, ignore the reality of quite significant net assets.

Any fan thinking the Glazers are about to go bust is an ill-informed fan.

If the Glazers were to sell the Bucs tomorrow, for example, they could clear most of United’s total debt at a stroke. They would own a debt-free United with massive annual profits. That remains an option to them and the reason why they haven’t done that yet, is, presumably, because they feel they can hold onto both clubs, using United’s money to pay their debt.

Understandably, that is not palatable to thousands of United’s fans; indeed it hasn’t been palatable for about five years. But until someone else offers the Glazers what they consider an offer too good to refuse, or until the Glazers’ business plan does actually collapse, the club will remain in their ownership.

The Glazer family insist a) the club is not for sale; b) that Sir Alex Ferguson has transfer money at his disposal, something he himself insists is true; c) that the business plan, underpinned by growing media and commercial income, is sound.

MUST and Green disagree; and time will tell who is right.

.

More stories mentioning Manchester United

Find out what the world’s top sportsmen REALLY earn, in our database, and in our Global Sports Salaries report

Sportingintelligence home page

.